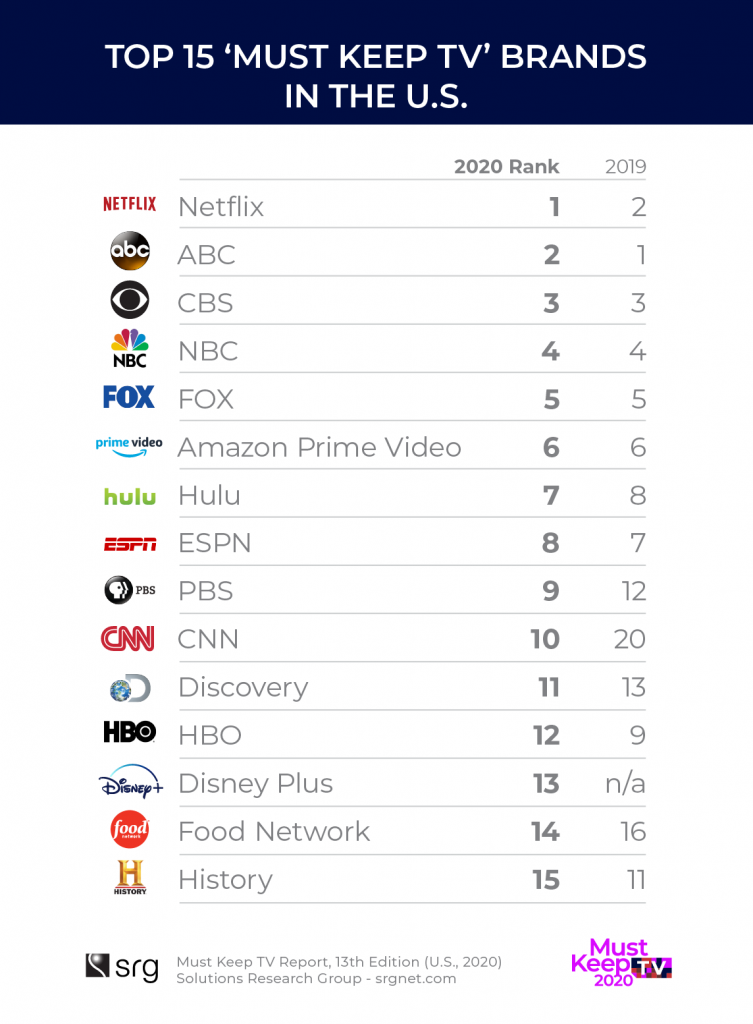

Entering SRG’s ‘Must Keep TV’ charts in the #4 position in 2017 when it was first added to the list, Netflix continued its ascendance by improving its chart position for each of the past 3 years and clinching the #1 spot in 2020, according to the results of the 13th annual “Must Keep TV Report,” from Toronto-based Solutions Research Group (SRG).

The research is based on 1,400 interviews across the U.S. with consumers aged 12 and older and conducted in the May 22-26 2020 window, just over two months into the coronavirus lockdown where most had a good chance to consume their regular brands and sample some new options.

The big four networks follow Netflix as ‘Must Keep’ with ABC, CBS, NBC and FOX rounding out the top 5.

Amazon Prime Video and Hulu are closely behind the networks, coming in at the #6 and #7 spots respectively.

Despite lack of live sports since March, ESPN continued its unbroken record as the top cable brand on the charts (#8 overall, #1 cable channel on the rankings), followed by PBS (#9) and CNN (#10) as consumer flocked to news during the coronavirus lockdown.

Top momentum brand in 2020 is Disney+, entering the charts in the #13 position out of 79 brands, in less than a year after its launch

Disney Plus was the big entry and the most significant momentum brand of the year, coming in at #13 among the total 12+ population – a higher entry position than Amazon Prime Video and Hulu which entered in #14 and #22 respectively in 2017 when they were added to the lists.

Other brands on the rise this year include Discovery, Food Network, Cartoon Network and FX. TLC and MSNBC also recorded significant gains in the rankers (MSNBC ranked #39, up from #46 and TLC ranked #29 up from #41).

Brands declining in ‘Must Keep’ status this year included AMC, CW and HBO. HBO exited the Top 10 for the first time since 2013 just before the launch of HBO Max. Other brands which lost ground in rankings include TNT which didn’t have NBA basketball during the pandemic.

Top 10 for 18-34s include the 4 big streamers, 4 broadcast networks, ESPN and The Cartoon Network

Netflix is #1 for the fourth year in a row and now we are seeing the rise of the other streamers in the rankings for younger Americans: Prime Video is now #2 just behind Netflix, followed by Hulu, both up two spots from their positions last year.

Disney+ is a Top 10 ‘must keep’ TV network for the A18-34 target already, entering the charts in the #8 position.

Brands with positive momentum in this demo include ESPN, home of the very popular and talked-about documentary ‘The Last Dance,’ and The Cartoon Network. HBO exited the Top 10 for A18-34s after 7 years, suggesting declining brand momentum. Other brands moving in the wrong direction this year include CW and AMC.

Other Trends…

Netflix rules among moms with kids (aged 12 or under) finishing in the #1 position again this year, followed by ABC and CBS. Hulu is in the #4 position, followed by Amazon Prime Video and Disney Plus which entered the ranker in this demographic in the #6 spot, ahead of FOX, NBC, Disney’s linear Channel and Nickelodeon.

Netflix topped the charts for African-American audiences this year followed by ABC and CBS. Fox came in at #4, followed by BET. CNN, Amazon Prime Video and The Cartoon Network all improved from last year’s rankings to end up in the Top 10 this year. Other momentum brands in this segment included OWN, PBS and MSNBC.

Netflix was also in the #1 spot for the Latino audience, followed this year by ABC and NBC. This is NBC’s best showing in this demographics since 2013. Others in the top 10 were FOX, Hulu, CBS, Univision, ESPN, Telemundo and Prime Video.

Technical: ‘Must Keep TV’ is an independent syndicated brand tracking survey conducted by Solutions Research Group (SRG) among a representative sample of American consumers. This is the 13th edition of the survey since 2007. The questions have been fielded and presented in a consistent manner each year. The 2020 research is based on online interviews with 1,400 American consumers aged 12 and older and conducted in the second half of May 2020 – the sample captures and represents all major population segments. For more information on how you can purchase the report, please contact Robin Dryburgh at robin@srgnet.com